Startups that can immediately impact the remote worker ecosystem will garner much attention. Even with vaccines, a largely remote workforce is likely here to stay. Remote work is and will continue to be, for the foreseeable future, a top-of-mind factor for venture capitalists. Investors will be looking for startups that can ensure customers will maintain compliance. Regulatory compliance, such as HIPAA, GDPR, and CCPA, is essential for organizations collecting and protecting user information, including virtually all enterprise-level companies. Investors also want to see financial reports and revenue growth projections backed up by market analysis. They want assurance that there is a marketable problem that the product solves. A Solid Business PlanĪnother factor investors have always looked for is an air-tight business plan.

This fact makes any startup’s quality of personnel and leadership a critical factor in the organization’s success. Investors can evaluate how the product and business model evolve before investing more capital. Lean research and development (R&D) show efficiency, even with limited resources. Investors are also looking for startups that can continue to improve their products without the need for substantial capital investment. When there are growth opportunities, startups should and usually do capitalize on them. Scalability will always be one of the most critical factors for investing in a successful startup. For example, companies with existing EDR, XDR, and SIEM systems can automate threat hunting workflows with Torq.Īlso read: Choosing a Managed Security Service: MDR, Firewalls & SIEM Investor Considerations for Cybersecurity Startups Potential To Scale, Lean R&D With a long and impressive list of potential use cases, teams can utilize Torq to automate security workflows related to cloud security posture management, email phishing response, application security, data security, and more. Torq is the no-code security automation platform for building and integrating workflows between cybersecurity systems. Over the years, SpiderSilk’s research has informed several high-profile breaches, and for clients, the vendor can simulate cyberattacks to ensure organizations take preventive measures before the real thing.Īlso read: Overcoming Zero Trust Security Challenges Best Identity & Access Management Startups Startup SpiderSilk offers an impressive proprietary internet scanner that maps out a company’s assets and network attack surface to detect vulnerabilities.

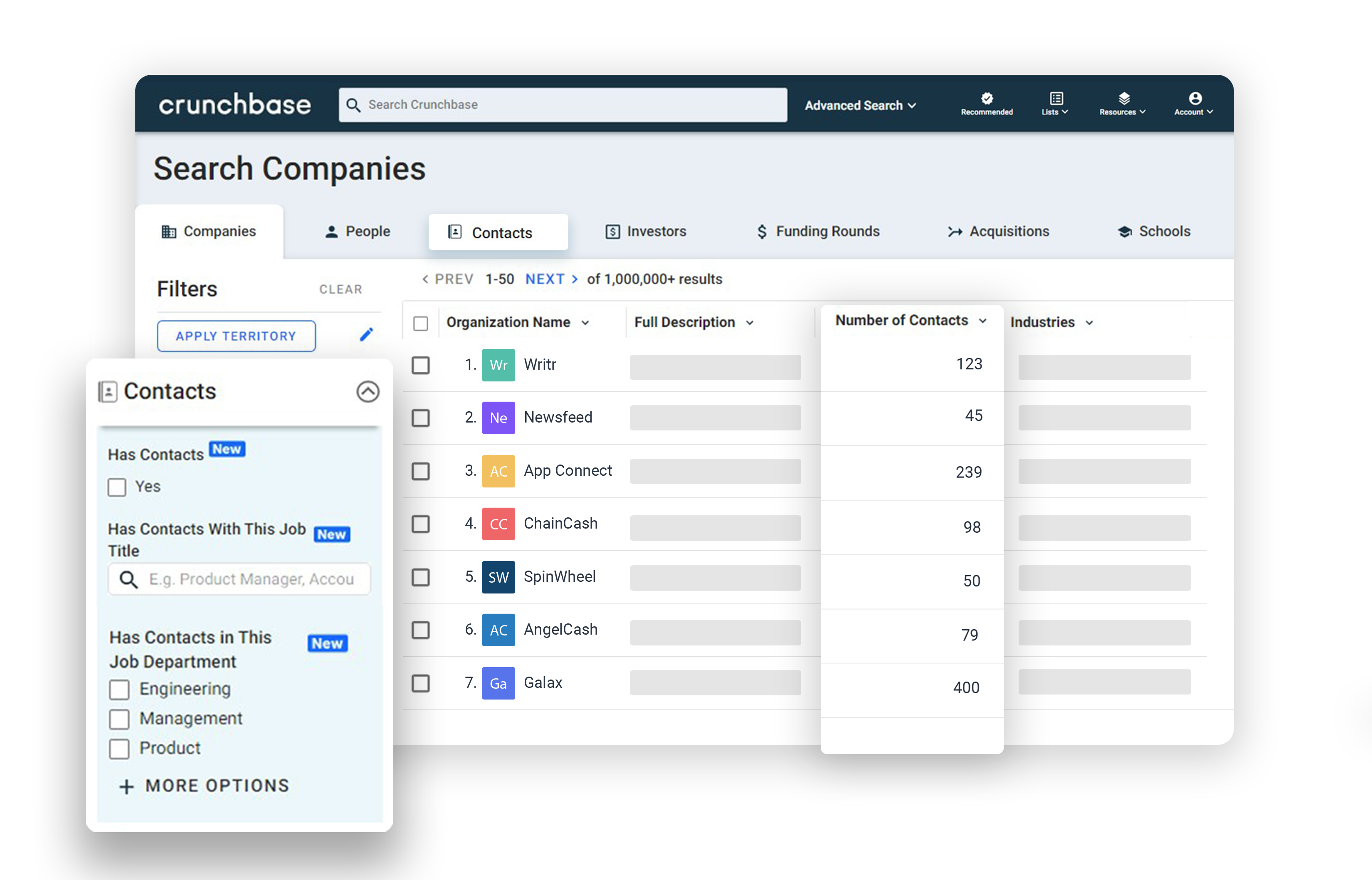

With robust visualizations of network devices and traffic, Sevco’s agentless asset intelligence platform gives network administrators the visibility to identify and remediate coverage gaps. Sevco Security is a cloud-native cyber asset and attack surface management platform offering a real-time inventory of assets, multi-source correlation, and asset telemetry to support incident response workflows. Investor Considerations for Cybersecurity Startups.Best Identity & Access Management Startups.Best Cyber Asset and Attack Surface Management Startups.We’ll start with the top 20 startups overall and then look at other noteworthy startups in a number of markets, including threat detection, identity, DevSecOps, cloud security, and attack surface management. You’ll find more detail beginning in our section on cybersecurity startup trends below. This article looks at the top 70 cybersecurity startups to watch in 2023 based on their innovations in new and emerging technologies, length of operation, early funding rounds, scalability, and more. While that’s down significantly from a record $22.8 billion in 2021, it’s still up 68% from 2020. VCs invested $15.3 billion in cybersecurity startups in 2022, according to Crunchbase.

information security products and services remain in high demand, and promising cybersecurity startups can still land eye-popping funding rounds. Despite economic headwinds and softening venture capital (VC) funding.

0 kommentar(er)

0 kommentar(er)